Not all members of registered pension plans are entitled to commute their pensions. However, if you’re a member of a registered pension plan, able to commute your plan membership and considering your options—or you’re an advisor working with a client who is considering commuting plan membership—don’t underestimate the significance of this decision: the value of a defined-benefit pension is usually a very significant financial asset on your personal balance sheet.

The risks associated with a poor or uninformed decision are high and could mean a plan member pays excess taxes

. . . or even runs out of money in retirement.

Finding a Skilled Advisor to Help

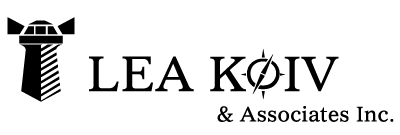

For a plan member to receive complete and competent advice about their pension options, the person providing assistance needs to have the following qualifications:

- Mastery of tax legislation

- Command of pension legislation

- Knowledge of insurance law and insurance products, especially “copycat” annuities

We are “trilingual” advisors who speak all of these languages: tax, pensions, and insurance. As a result, not only do plan members seek us out in order to access our specialized advice—but so do other advisors who want to ensure their clients get appropriate and complete decision support.

Taxation Law

- Has the Maximum Transfer Value calculation been verified?

- Are the potential savings under the Pension Splitting Rules being maximized?

- Is any Old Age Security clawback minimized?

- What is the tax treatment of any supplemental plan?

- Are there other tax planning opportunities?

Pension Law

- What are the “normal” and other forms under the plan?

- What are the transfer options and associated age limits under the plan?

- Does the plan offer any ancillary benefits?

- What are your estate values if you remain in the plan?

- What are the locking-in requirements, and do they present any planning opportunities?

Insurance

- Does the plan offer an annuity option?

- Is a copycat annuity an option and if yes, how can it be ensured that a copycat annuity is not materially different from the plan provisions as required by tax legislation?

- If the pension is commuted, have any associated insurance needs been addressed?

Whether you are a plan member seeking advice on your options, or an advisor looking to help a client with clarity on a pension decision, we would be pleased to assist. We have direct experience advising on a wide range of plans.

We urge plan members to be cautious when seeking the appropriate advice. For example, not all advisors are licenced to offer annuity products (nor may they even be aware that an annuity may be the appropriate solution), hence they do not raise the option of a copycat or other annuity—which can mean they are leaving their clients exposed to higher tax bills or increased longevity, market and other risks.

Commuting a Pension: Understanding your Options

A plan member who is able to commute their pension may have the following options:

- Remain in the plan

- Transfer the commuted value of the plan to another registered pension plan (including possibly an Individual Pension Plan)

- Transfer an amount up to certain limits, set by the Income Tax Act, to a locked-in retirement arrangement and pay tax on any remaining balance, or

- Acquire a “copycat” annuity with the commuted value

There is no one-size-fits-all solution appropriate in every situation. Instead, a decision should only be made after identifying and carefully considering all options, balanced with the plan member’s overall circumstances, goals, needs and preferences. This is what we do.

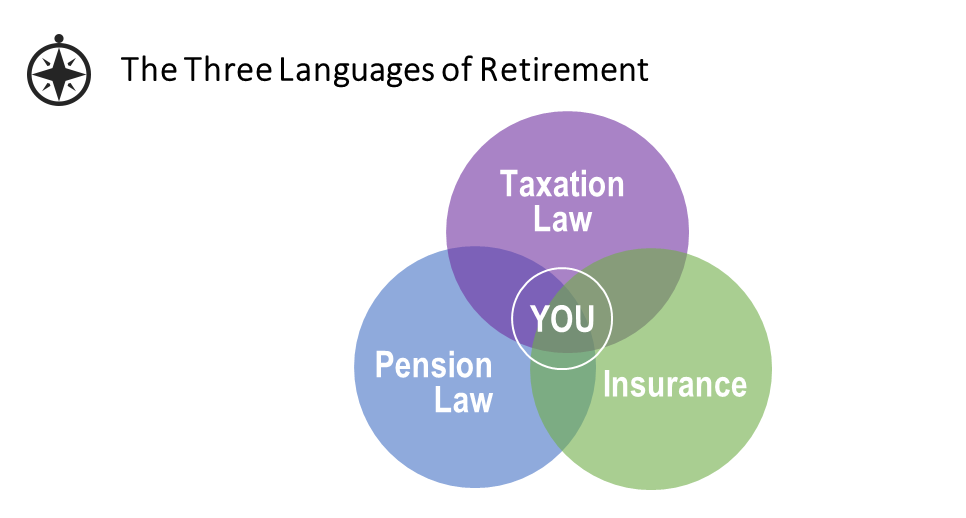

Our Process

- Discovery: The plan member completes a questionnaire to provide appropriate information regarding their circumstances, and an authorization form allowing us to confirm plan details directly with plan administrators, as required

- Initial Review:

- The termination statements provided to the member

- The employee plan booklets, where avaialble

- The pension plan text, where required

- Website for the plan, where required

- Statement of Contributions for CPP, where available

- Third-Party Confirmation: Discussions with the plan administrator and/or employer to confirm plan details, where required

- Summary Report: Preparation of a detailed, expert report analyzing the options available to the plan member

- Presentation of Options: Meeting (whether in person or by teleconference) with the plan member to present and discuss available options

- Planning Engagement: Preparation of a retirement plan, where requested, in order to evaluate the impact of the plan member’s decision on their overall retirement readiness and plan

The appropriate decision may be for the plan member to remain in the plan. It may be to commute. The advice we provide is independent—we are completely agnostic as to the outcome—and yes, there is a fee.

Charging a fee ensures that the advice plan members receive is independent and we are not promoting any transfer of the assets in order to receive commissions.

Who do we help?

We have advised a wide range of clients as to their entitlements from both registered pension plans and supplemental pension plans (including retirement compensation arrangements).

- Plan members come to us upon their termination of employment and/or retirement, as well as when their defined benefit plans are being converted to defined contribution arrangements, or are being wound up.

- Other advisors come to us when their clients need independent and authoritative advice about the pension options available to their clients facing a pension decision.

For independent, expert advice, call us.

Selected list of plans we’ve advised on:

- AOA Canada National Chapter Pension Plan (plan for Cathay Pacific Pilots)

- Bruce Power

- Canada Life Employees’ Pension Plan

- Canadian General Electric Pension Plan

- Dupont Canada

- Ford Motor Company

- General Electric (GE) Alstom

- General Motors (GM)

- Hydro One

- Johnson & Johnson Canadian Affiliated Companies

- Local Authorities Pension Plan

- Nuclear Waste Management Organization Pension Plan

- Ontario Power Generation (OPG)

- Ontario Teachers’ Pension Plan (OTPP)

- Pension Plan for Employees of Hanson Pipe & Precast Limited

- Pension Plan for Non-Bargaining Employees of Hanson Brick Ltd

- Regina Police Pension Plan

- The Retirement Annuity Plan for Employees of the Ontario Mutual Insurance Association and Member Companies

- Scotiabank Pension Plan

- Suez Water Technologies and Solutions

- Target Retirement Income Plan for Regina Police Services

- The Star

- Yellow Pages

- Public Service Pension Plan